Bitcoin Price Prediction as Crypto Research Firm Says BTC Could Fall to $20,000 – What’s Going On?

[ad_1]

Amidst ongoing discussions about the trajectory of Bitcoin’s value, the cryptocurrency market is abuzz with speculation.

Fairlead Strategies’ Katie Stockton has added fuel to the fire by suggesting that Bitcoin’s price could potentially regress to the $20,000 range, a notion that has gained traction given its recent rebound from those levels earlier in the year.

Currently trading at $26,470 with a 1.65% increase today, BTC/USD seems to be under the spotlight once again.

However, market dynamics could take a different turn, influenced partly by Jerome Powell’s forthcoming Jackson Hole speech, which looms as a potential source of volatility for the crypto markets.

Amidst these discussions, Bitcoin miners continue to demonstrate confidence, contributing to the ongoing market narrative.

Crypto Research Firm Says BTC Could Fall to $20,000

According to insights from Katie Stockton, an analyst at Fairlead Strategies, the possibility of Bitcoin revisiting the $20,000 range has garnered more attention.

Stockton’s recent commentary suggests a potential resurgence of this price level, considering Bitcoin’s robust rebound from those values earlier this year.

Stockton’s analysis also underscores the significance of the $25,200 threshold as a crucial support level for Bitcoin.

In the event that the cryptocurrency undergoes a decisive breach beneath this mark, the subsequent support bracket at $20,600 becomes pivotal.

This lower support range can translate into a 21% decline from the current market levels.

As of Wednesday, Bitcoin was traded at $26,191, lending further credence to the ongoing discourse surrounding its potential movement.

Jerome Powell’s Jackson Hole Speech Poses Volatility Threat to Crypto Markets

Federal Reserve (Fed) Chair Jerome Powell’s upcoming speech at the Jackson Hole Symposium is anticipated to have an impact on the price of Bitcoin and the broader cryptocurrency markets.

These markets have recently experienced notable declines, similar to other high-risk assets.

Bitcoin’s price, which is currently hovering above the significant $25,000 level, has been relatively stable since the sharp drop on August 18, as investors exercise caution ahead of the symposium that will be held from Thursday to Saturday.

Powell’s speech at 14:05 GMT on Friday is expected to draw significant attention, with markets eagerly anticipating insights into the evolving monetary policy stance and the Fed’s response.

If Powell takes a hawkish stance, suggesting more rate hikes, Bitcoin’s price might plummet.

Conversely, indications that interest rates won’t rise further could boost demand for risk assets, including Bitcoin.

Historical analysis demonstrates that the symposium has notably impacted both the S&P 500 and crypto prices, with Bitcoin typically responding negatively.

Notably, the S&P 500’s atypical 2022 performance raises uncertainty about this year’s effects.

Over 2018-2022, Bitcoin’s price has shown a range of reactions, dropping between 3.5% and 10.5% due to symposium developments, while in 2018, it gained 7.72%, mirroring the S&P 500’s positive correlation.

Given this scenario, the upcoming speech by Powell might be capping further gains in BTC prices today.

Bitcoin Miners Remain Optimistic as BTC Sees Gains

Despite a 10% decrease in BTC/USD last week, Bitcoin miners appear to be showing resilience in the face of the price decline.

On August 22, network activity exemplified this as mining difficulty surged by 6.17% during the biweekly automated readjustment, propelling it to an all-time high.

This marks the sixth significant uptick in difficulty for 2023, emphasizing miner confidence and network security.

The hash rate, which reflects miners’ hashing deployment to the blockchain, is nearing record levels of over 400 exahashes per second.

This data indicates a strong belief in the security and dependability of the Bitcoin network, despite the recent dip in prices.

The fact that prices dropped while intrinsic value increased suggests that BTC may be undervalued.

The amount of BTC held by mining entities has remained relatively steady at around 1.83 million BTC as of August 22, indicating little change since the beginning of the month.

This confidence from miners has improved the outlook for BTC, and may have contributed to the 1.65% increase in BTC value today.

Bitcoin Price Prediction

Bitcoin, a popular digital currency, has recently bounced back from its support level of $25,500.

As of now, the BTC/USD is showing signs of bullish correction, which may help it reach a value of $27,400.

The Bitcoin price chart, sourced from Tradingview, indicates a potential positive outcome where a bullish breakout above $27,400 could propel BTC towards the $28,650 mark.

Additionally, there is a possibility that BTC may climb up to $30,300.

However, there is also a negative outcome where a bearish breakout of $25,450 could result in a decline towards $24,100.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

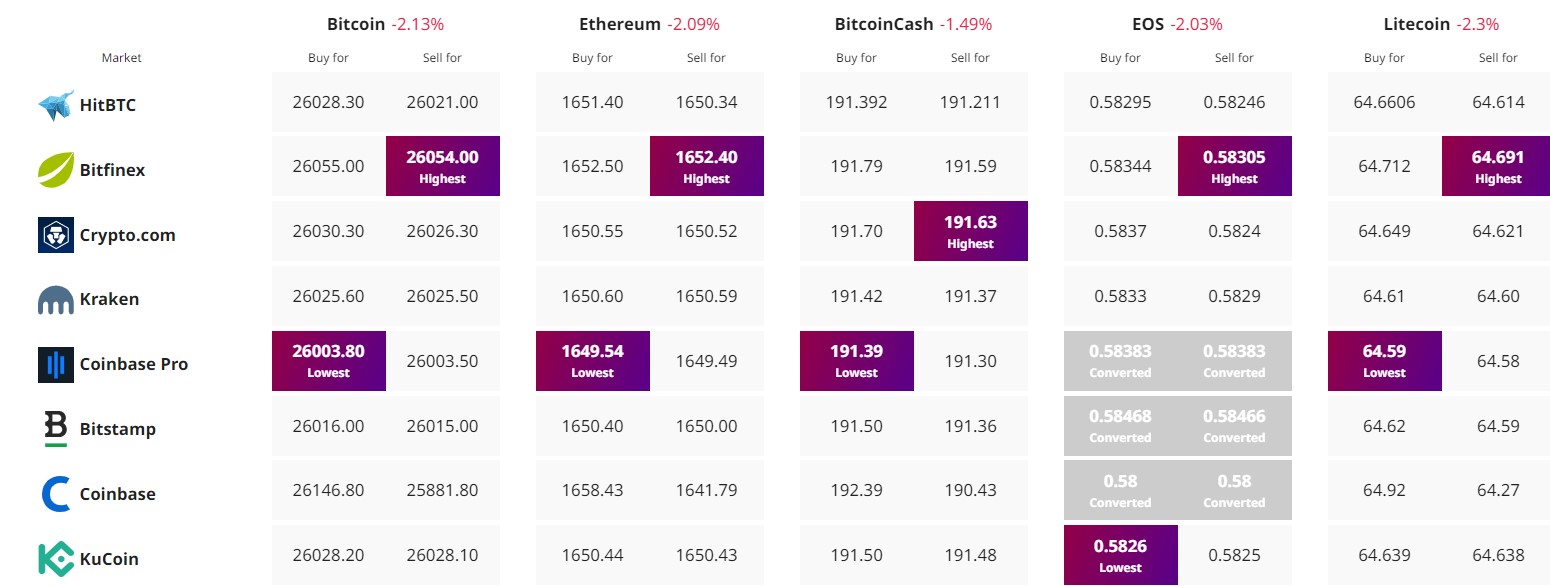

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

[ad_2]

Source link