Is the Bitcoin Rally Dead or Alive?

[ad_1]

On May 3 and May 4, 2022, the Federal Open Market Committee (FOMC) meeting decision to raise interest rates sent ripples through the crypto market. This led many to believe that the Bitcoin rally would not continue to the all-time highs seen in November 2021.

One year on, examining the ongoing relationship between interest rates, equities, and cryptocurrency markets is important.

The Evolving Crypto Landscape

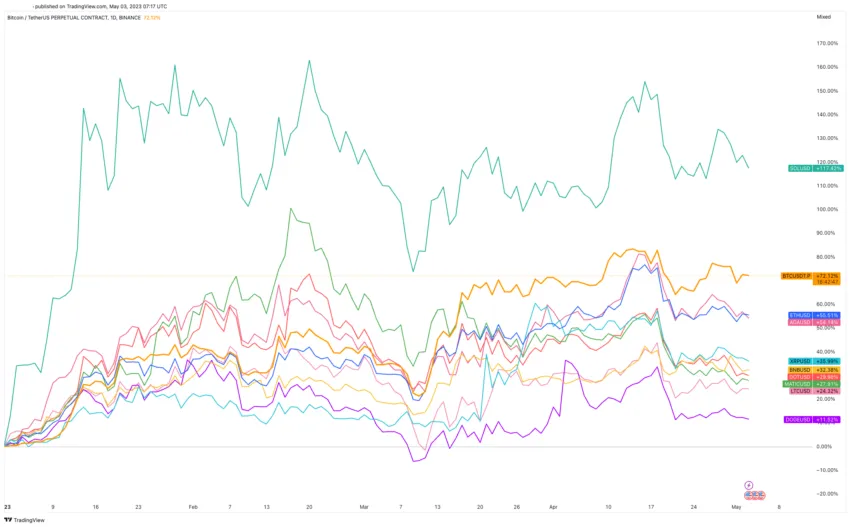

Despite the initial shock, the Bitcoin rally started, and prices managed to climb over 70% since the start of the year. However, the past 30 days have seen assets diverging from one another, charting unique paths.

This presents opportunities for those closely engaged with on-chain and social statistics. It helps them make informed decisions before one coin pumps and another dumps.

Bitcoin and Equities: A Growing Correlation

The crypto market has shown an increasing correlation with the US equities market. This trend may be influenced by the FOMC’s consistent raising of interest rates over the past year. Around Fed interest rate decision time, the correlation between these two sectors tightens.

Higher interest rates lead to increased borrowing costs, reducing consumer and investor spending. This can negatively affect equity markets and, in turn, reduce demand for cryptocurrencies.

On the other hand, lower interest rates can increase spending, stimulate economic growth, and positively impact both equities and cryptos.

Market analysts closely monitor the Fed FOMC decisions and their impact on the broader economy and financial markets, including the cryptocurrency sector.

Crypto Community’s Sensitivity to Interest Rate Decisions

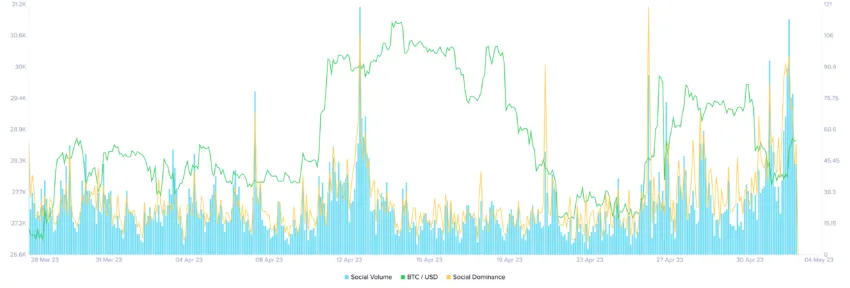

The crypto community is highly tuned in to upcoming FOMC decisions and likely to react sensitively to the outcomes. An increased focus on monetary-related subjects such as banks, tax, money, fees, and stables indicates that the community is closely monitoring fiscal policy.

One positive result of the increased concern that “we may have topped” is that Bitcoin has become a more significant focal point.

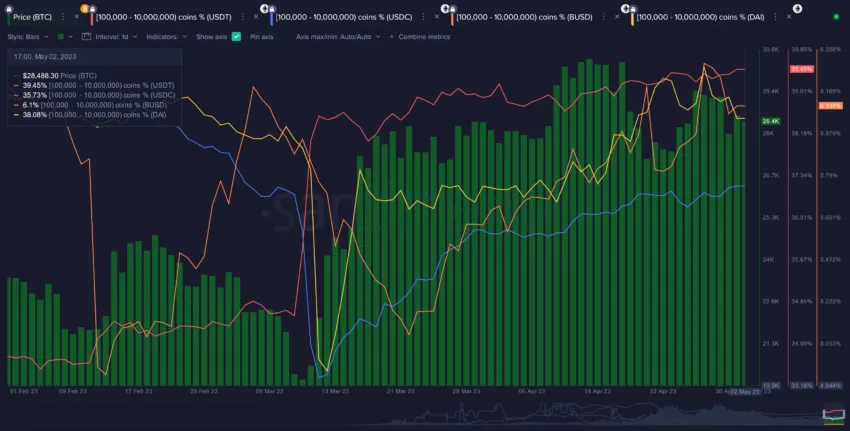

Bitcoin sharks and whales, holding between 100 and 10,000 BTC, had accumulated back to where they started when they began their sell-off in late March.

Meanwhile, stablecoin accumulation, particularly USDT (red line) and USDC (blue line) has increased since the beginning of June.

This market behavior suggests more organic money is coming back into crypto with less than one year until the 2024 Bitcoin halving.

Bitcoin Rally in Trouble as Network Activity Slows Down

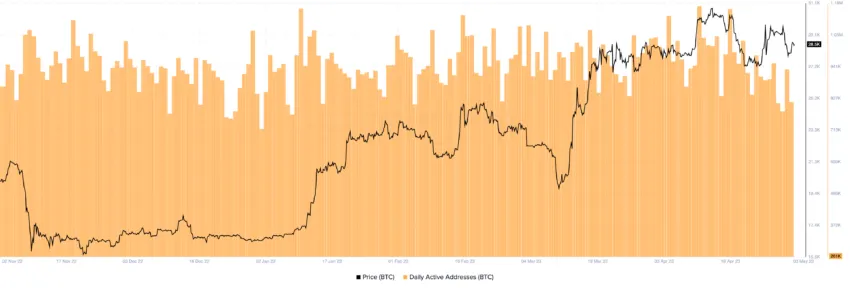

Despite the positive signals, there are concerns about the lack of unique addresses interacting on the BTC network.

Over the past two weeks, there has been a peculiar drop in active addresses per day. The utility must remain stable to confirm a breakout can happen alongside other bullish signals.

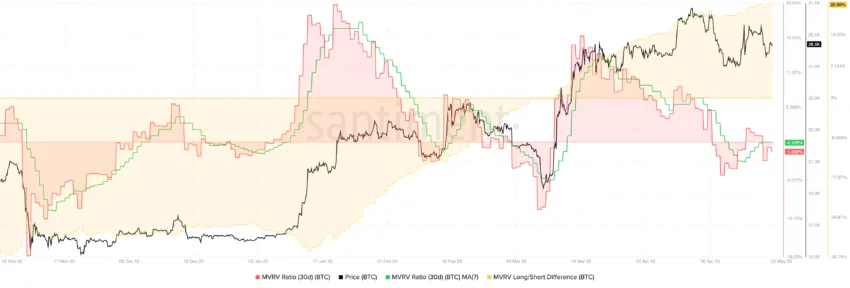

The 30-day MVRV ratio (in red) is back below 0%, meaning that the average trader in the past 30 days is down again. When this occurs, there is a lower risk than the average of being in crypto.

Still, the long-term 365-day MVRV (in yellow) is still sitting at +25%.

All Eyes on the Fed

The relationship between the Fed’s interest rate decisions, the equities market, and the cryptocurrency market continues to evolve. As the FOMC continues to impact the broader economy, the cryptocurrency community remains sensitive to changes in fiscal policy.

The growing concerns about unique addresses and network activity could take a toll on the Bitcoin rally. Still, as the 2024 Bitcoin halving approaches, the crypto market’s response to interest rate decisions will remain crucial.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link