Bitcoin Price at Risk of Losing $25,000 as Bears Gain Momentum

[ad_1]

Bitcoin (BTC) dipped below $27,000 on Wednesday as the global crypto market capitalization shrunk by 2%. On-chain analysis examines the short-term merits of Binance CEO Chanpeng Zhao’s recent bullish statements amid escalating tensions in the Middle East.

Bitcoin price could surpass its previous all-time high of $61,000 in 2024, according to a recent statement released by Binance CEO Chanpeng Zhao (CZ). However, recent macro events and BTC derivatives market data are conflicting.

Bitcoin Price Under Pressure Despite CZ’s Optimistic Halving Prediction

On Wednesday, October 11, Binance added the Bitcoin halving countdown to the exchange platform’s homepage. While making the announcement, CEO Chanpeng Zhao highlighted BTC’s historical cycle of reaching new all-time highs after each of the last 3 halving events in 2012, 2016, and 2020, respectively.

While Bitcoin maxis widely acknowledges CZ’s bullish sentiment, recent events in the derivatives market paint a bearish short-term picture. According to data compiled by Coinglass, BTC bulls took a $25 million hit on Wednesday, extending their losing streak to 6 days.

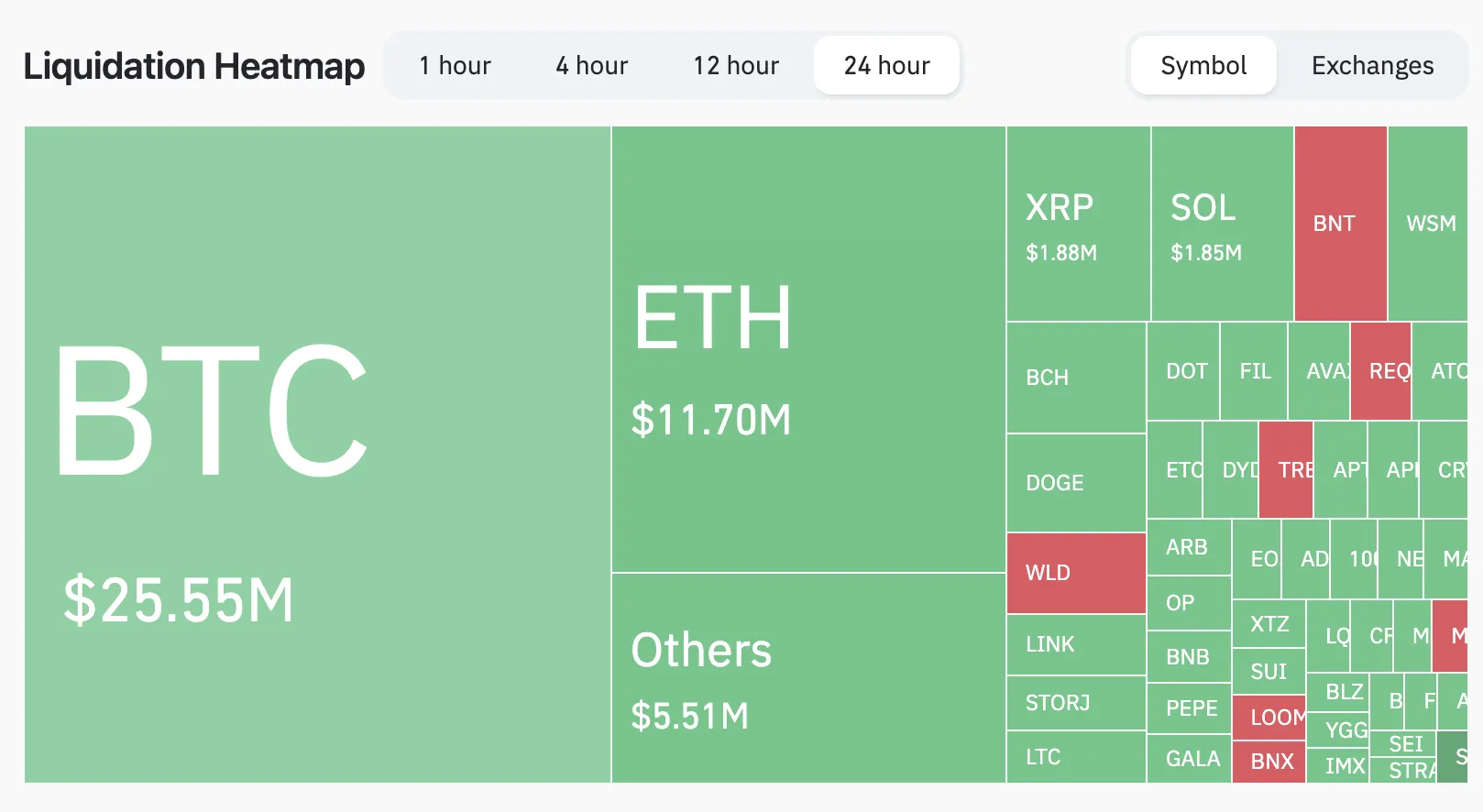

The Liquidation heatmap offers an overview of the cumulative crypto derivatives market positions that have been liquidated or closed over a given period.

The chart above illustrates that BTC dominates crypto market losses with over $25 worth of LONG positions (bets on BTC price increase) liquidated on Wednesday alone.

The corresponding 2% decline in the global crypto market cap suggests that rather than buy more BTC to defend their positions, investors are exiting the market.

If this circumstance persists BTC spot market prices could drop closer to $25,000 in the days ahead.

Bitcoin Bears Have Seized Control of the Market

Bitcoin made a positive start to the month, making multiple attempts at breaking the coveted $28,000 resistance. Notably, Bitcoin Dominance (BTC.D) captured a 4-month high of 51% in the process.

However, the derivatives market data shows that the Israel-Palestine crisis has tilted the momentum toward the bears. Between October 7 and 11, BTC Long position holders have suffered more losses than short traders.

Over $55 million worth of long positions were liquidated during that period.

The Total Liquidations metric weighs the total value of Longs closed against the Shorts during a given time frame. As seen above, the bears have gained the upper hand in 5 consecutive trading days since the geopolitical crisis between Israel and Palestine broke out.

It remains to be seen if highly-leveraged Long traders holding positions below the current prices will pile on buy pressure to avert further Bitcoin price downside.

BTC Price Prediction: Losing $25,000 Could Trigger Larger Losses

Bitcoin price looks poised to drop closer to the $25,000 level in the days ahead, based on the current market data insights. However, the In/Out of the Money, which depicts the entry price distribution of current BTC holders, offers a less pessimistic outlook.

It shows that a major support cluster of holders bought Bitcoin around the $26,300 level.

As shown below, 1.95 million addresses had bought 811,310 BTC at the maximum price of $26,695. If they HODL steady, they could avert further losses.

But if bears break that support level, BTC could rapidly drop toward $25,000.

On the upside, the bulls could regain control if the Bitcoin price can reclaim $30,000. But in that case, 2.5 million addresses had bought 1.06 million BTC at the average price of $28,300.

They will likely trigger an instant bearish Bitcoin price reversal if they book profits early.

But if the resistance cluster cannot hold, the psychological resistance at $30,000 could be the next stop.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link